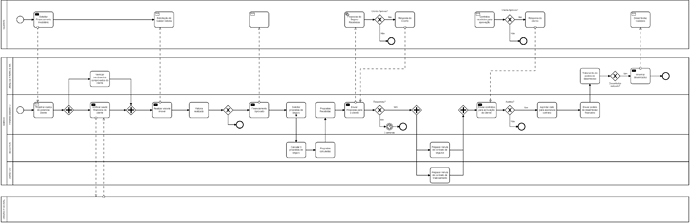

Real estate financing application

pedido-de-financiamento-imobili-rio.bpmn (40.3 KB)

The customer always makes the financing request directly to the bank (without the intermediary of a

financing) and always get the answer directly from the bank.

When the bank’s finance department receives the customer’s order, the bank must record the

potential customer. Then the bank’s finance department must check the customer’s financial health.

with the specialized federal agency, whose internal procedure is not known. Furthermore, the department of

The bank’s financial analysis must verify the client’s proven earnings. These two checks must be

performed in parallel to streamline the process. Subsequently, the responsible department must carry out an inspection in the

immobile. Based on these three checks, the funding department must decide whether funding should be

approved or denied, and the customer is duly notified. If the funding is approved, the department of

insurance must carry out the calculation of three different insurance proposals from the financing so that the department of

financing presents them to the customer, who must choose one of them and return to the bank at his choice.

This bank offers a promotion that its decision must be made public within a week. every week

that the decision is not disclosed, a 0.5% reduction in the interest rate must be applied, if the financing is

finally approved.

Once the customer receives the approval notification, he must accept or reject it, directly to the department.

of bank financing. If the bank’s finance department receives confirmation from the customer, the

legal department must prepare the draft financing agreement, which must be sent to the customer for

revision. In parallel, the insurance department must prepare the draft financing insurance contract, which

must also be sent to the customer for review. Both contracts must be sent together by the department

of funding. Once the customer returns with their acceptance of the contracts, a date must be scheduled for

that the contract is signed between the parties.

Finally, the finance department submits a disbursement request to the finance department. When

this order has been handled, the finance department informs the customer directly.

At any time during the financing request process, the customer can inquire about the status of the

your request to the bank’s finance department. In addition, the customer can request the cancellation of the

order also at any time. In this case, the finance department must calculate the interest rates

request processing that the customer will have to pay for the service already provided, which depend on how far the

request process has gone, and communicates them to the customer. The customer can respond within two days with a

cancellation confirmation, in which case the process is cancelled, or with a cancellation withdrawal, in which case

that the process continues. If the process has to be cancelled, the bank may need to cancel the contracts issued

or even already signed and, as a last resort, cancel the disbursement already made