Hi Philipp,

Yes, we read the BPMN and DMN started guides, even, we bought the book Real-Life BPMN Book and we were playing with the platform for a few days.

The specific question is the following:

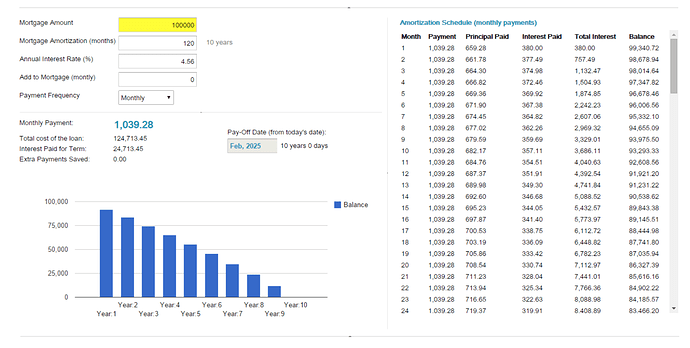

1.- Business department give us the process definition about Mortgage Simulator.

2.- We expected obtain the following from of the Simulation:

We map the requirements in point 1 to a Camunda BMPN model to be executed in Camunda but to obtain the Amortization Schedule on the right (Monthly Payment):

public List<Payment> calculatePaymentList(Date startDate, double initialBalance, int durationInMonths, int paymentType, double interestRate, double futureValue)

{

List<Payment> paymentList = new ArrayList<Payment>();

Date loopDate = startDate;

double balance = initialBalance;

double accumulatedInterest = 0;

for (int paymentNumber = 1; paymentNumber <= durationInMonths; paymentNumber++)

{

if (paymentType == 0)

{

loopDate = addOneMonth(loopDate);

}

double principalPaid = paymentService.ppmt(paymentService.getMonthlyInterestRate(interestRate), paymentNumber, durationInMonths, initialBalance, futureValue, paymentType);

double interestPaid = paymentService.ipmt(paymentService.getMonthlyInterestRate(interestRate), paymentNumber, durationInMonths, initialBalance, futureValue, paymentType);

balance = balance + principalPaid;

accumulatedInterest += interestPaid;

Payment payment = new Payment(paymentNumber, loopDate, balance, principalPaid, interestPaid, accumulatedInterest);

paymentList.add(payment);

if (paymentType == 1)

{

loopDate = addOneMonth(loopDate);

}

}

return paymentList;

}

/**

* Emulates PMT(interest_rate, number_payments, PV, FV, Type) function, which calculates

* the mortgage or annuity payment/yield per period.

*

* @param r periodic interest rate represented as a decimal.

* @param nper number of total payments or periods.

* @param pv present value – borrowed or invested principal.

* @param fv future value of loan or annuity.

* @param type when payment is made: beginning of period is 1; end, 0.

* @return double representing periodic payment amount.

*/

public double pmt(double r, int nper, double pv, double fv, int type)

{

if (r == 0) {

return -(pv + fv) / nper;

}

// i.e., pmt = r / ((1 + r)^N - 1) * -(pv * (1 + r)^N + fv)

double pmt = r / (Math.pow(1 + r, nper) - 1) * -(pv * Math.pow(1 + r, nper) + fv);

// account for payments at beginning of period versus end.

if (type == 1) {

pmt /= (1 + r);

}

// return results to caller.

return pmt;

}

/**

* Emulates IPMT(interest_rate, period, number_payments, PV, FV, Type) function, which calculates

* the portion of the payment at a given period that is the interest on previous balance.

*

* @param r periodic interest rate represented as a decimal.

* @param per period (payment number) to check value at.

* @param nper number of total payments or periods.

* @param pv present value – borrowed or invested principal.

* @param fv future value of loan or annuity.

* @param type when payment is made: beginning of period is 1; end, 0.

* @return double representing interest portion of payment.

* @see #pmt(double, int, double, double, int)

* @see #fv(double, int, double, double, int)

*/

public double ipmt(double r, int per, int nper, double pv, double fv, int type)

{

// Prior period (i.e., per-1) balance times periodic interest rate.

// i.e., ipmt = fv(r, per-1, c, pv, type) * r

// where c = pmt(r, nper, pv, fv, type)

double ipmt = fv(r, per - 1, pmt(r, nper, pv, fv, type), pv, type) * r;

// account for payments at beginning of period versus end.

if (type == 1) {

ipmt /= (1 + r);

}

// return results to caller.

return ipmt;

}

The problem is we don`t able to understand how to invoke this in the bpmn/dmn process and return the List.

Thank you in advanced

Best regards,

JE